KAREO BILLING Rejection and Denial Management

Get Paid Faster by Reducing Denials, Rejections and No Response Claims

Rejection and Denial Management

view details

Rejection and Denial Management

view details view less

view less

Get paid faster and save time with Kareo Billing’s Denial Management tools that includes unique reports like the details of a denial. It enables you to address the root cause of your denials so you can reduce the number you encounter on a daily basis. Billers can automatically flag denials that require review, efficiently resolve denials and resubmit insurance claims.

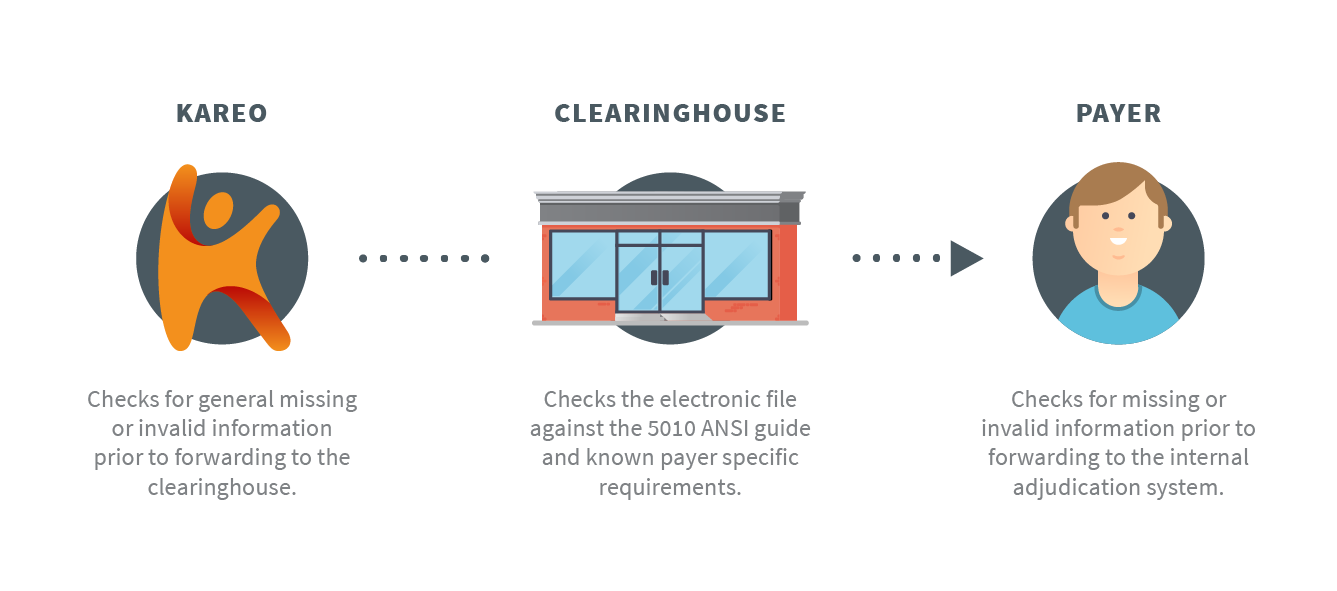

As part of our robust claim processing within Kareo Billing, your claims will go through three separate reviews before reaching your payer’s internal adjudication system. The best part is that it’s all done electronically so you get immediate notification.

All three review phases check for correct claim formatting rules (i.e.: patient address, service location, diagnosis/procedure codes, payer ID, etc.). If there is missing or invalid information, Kareo will let you know that the claim won’t be forwarded on to the next reviewer through a rejection report. This allows you to course-correct in the moment by reviewing the rejection, applying corrections, and resubmitting the claim. Reducing errors in claims is the key to getting paid faster and Kareo Billing can help.

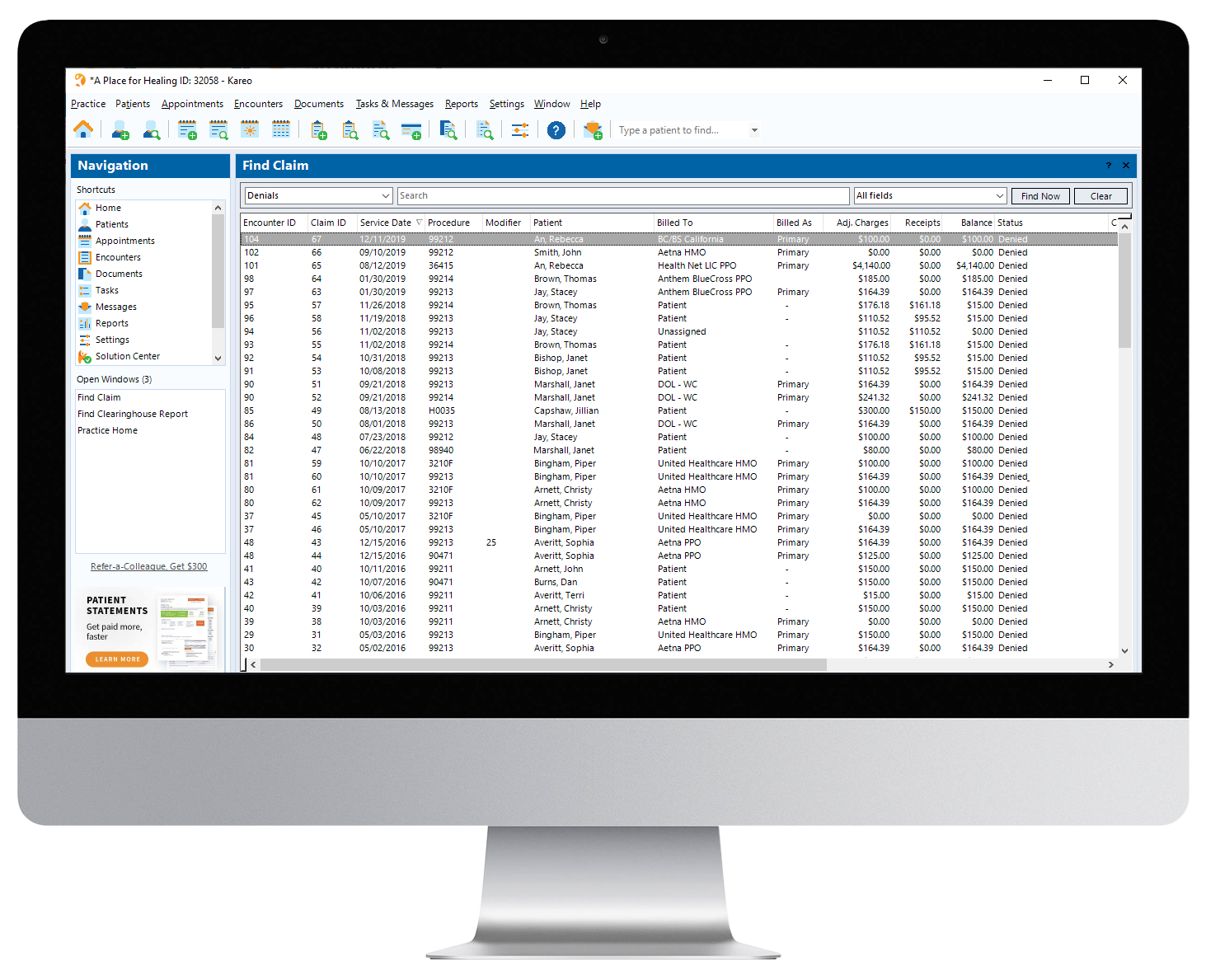

Kareo Denial screen summarizes conveniently summarizes your denials. Easily edit the claim electronically.

Always Know the Status of your Claims with Automatic Denials & Rejections

Once you submit electronic claims, our clearinghouse partners will check the format of your claims for any missing information and validate claims against payer-specific formatting requirements. If there are problems, you will receive a claim processing report that offers insight into Level 1 and Level 2 rejections, so you know exactly what needs to be resolved before submittal to payers. Kareo Billing automatically categorizes rejected claims for correction and resubmission, and you can see where everything is in the process.

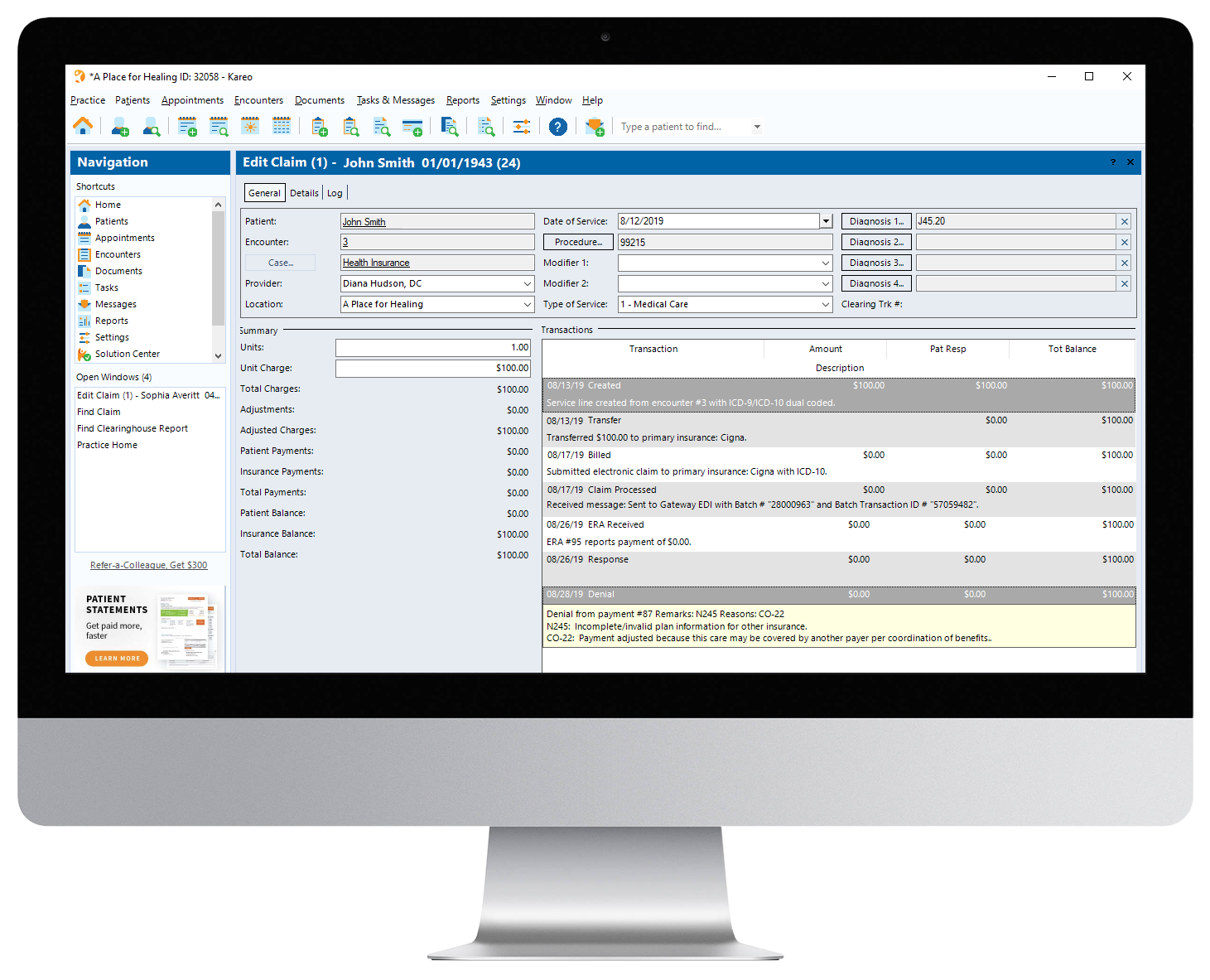

Once your claims have passed all Kareo and clearinghouse reviews, they will be sent on to payers for adjudication and payment. If enrolled with Kareo for electronic remittance advice services, you will receive an electronic remittance advice report back from payers that shares the details about payments and any denials. Anytime you post a denial, Kareo will change the status of your claims to "denied," and automatically categorize your denied claims for correction and resubmission.

Resolve Denials and Rejections Efficiently

Since Kareo categorizes your insurance claims as "Rejected" or "Denied", your insurance claims are automatically organized into the appropriate work list. For each rejection or denial, you'll see information about the insurance claim with a designated rejection or denial reason. Simply drill-down into the claim to correct and resubmit it. After each insurance claim has been resubmitted, it will be automatically removed from your work list. Additionally, Kareo provides tools at your fingertips to fix rejections that occur, allowing billers to reference our help page that guides you through the process of handling rejections. This can be accessed quickly from our insurance claim screen and eliminates the hassle of having to call support lines and the clearinghouse direct. It's really that efficient!

Minimize the Amount of Time Your Claims Spend in Neverland

Kareo Billing will filter unpaid claims from “pending insurance” to “no response” based on triggers that you set in your fee schedules. Billers can set triggers for a specified number of days – typically 21 for e-claims and 30 days for payer claims – to identify claims that may be stuck in a queue line. This helps you quickly recognize the items that need your attention and follow-up with the payer, minimizing the number of unpaid claims.

Address Root Causes of Denials and Rejections

Kareo Billing makes it easy and convenient to identify and resolve your denials and rejections, but it also helps you address the root cause of the issue so you can avoid potential denials and rejection in the first place. Kareo Billing’s powerful reports group your denials and rejections by reason, dollar amount, and other trends, so you can identify frequently recurring denials and rejections that can be resolved through a simple process change. For example, if you routinely receive denials due to patient ineligibility, it will be important to verify patient insurance eligibility prior to scheduling appointments.

FEATURES

Kareo makes it easy to automate your payments process:

- Real-time awareness into claim status, including those requiring an immediate response

- Shortcuts that lead directly to tools and articles to help resolve your rejections quickly

- Automatic, electronic process allows for minimal user input and faster identification of potential issues

- Transparent “to-do” work list allows users to quickly identify items that need attention

- Reports enable you to see trends in your rejections and denials, so you can proactively resolve recurring issues