Increase collections by verifying every patient's insurance benefits

Insurance eligibility technology increases collections by eliminating uncollectible revenue from patients with invalid or insufficient insurance benefits. You can verify insurance during patient registration and appointment scheduling and receive a real-time response with details about the patient's insurance benefits. By verifying insurance coverage prior to each patient visit, you can increase collections and save time.

Introducing Eligibility Technology

Over the past few years, the healthcare industry has implemented a standard for verifying insurance benefits electronically to help providers reduce denied insurance claims and manage the payment responsibility of their patients. This standard goes by the technical label ANSI 270/271, but is commonly referred to as "Insurance Eligibility", "Real-Time Insurance Eligibility", or "Insurance Eligibility Benefit Inquiry and Response". These standards enable a healthcare provider to submit an electronic inquiry to verify a patient's insurance beneifts and to receive an immediate response with details about the patient's insurance policy, such as the medical services covered and the terms of the patient's copay, coinsurance, and deductible.

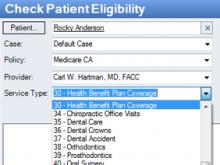

Submit Insurance Eligibility Inquiry

You can submit insurance eligibility inquiries to hundreds of government and commercial insurance companies including Medicare, Medicaid, Blue Cross and Blue Shield in nearly every state and every most commercial insurance company including Aetna, Cigna, Humana, United Healthcare, and many more. To check eligibility, you'll need basic information about the patient, the insurance policy information including the insurance name and the policy number, the provider's tax ID and NPI numbers, and the type of medical service the patient will receive.

Receive Insurance Eligibility Response

Once you submit an insurance eligibility inquiry, you'll receive a response in real-time, usually in 30 seconds or less. The response you'll receive will be in a standard format that will provide information about whether or not the patient is covered at all by the insurance company, and if so, the level of benefits for different categories of medical service and the information about the patient's payment responsibilities, such as the deductible, copayment, or coinsurance required. The insurance eligibility report can be viewed on-screen, printed, or and saved to the patient's record and insurance policy file where it can be opened at a later time.

Next Feature, Watch a Demo, Read Reviews, or See Pricing & Sign Up